Chargebee, a subscription management platform, has forged a partnership with Pipe, a startup that offers SaaS (software-as-a- service) companies an alternative way to grow.

For those who are unfamiliar, SaaS (also known as cloud-based) companies report revenue on an annual basis. But because most customers prefer to pay on a monthly or quarterly basis, some SaaS operators might struggle with cash flow throughout the course of a year.

In order to keep operating, they may turn to raising dilutive external capital or taking on venture debt.

Pipe was founded in September 2019 to give SaaS companies a way to get their revenue upfront by pairing them with investors on a marketplace who pay a discounted rate for the annual value of those contracts. (The company describes its investor partners as “a vetted group of financial institutions and banks.”)

The advantage for the SaaS company is that they don’t have to dilute their ownership by accepting external capital, nor do they have to take out a loan, says Pipe co-founder and co-CEO Harry Hurst.

Meanwhile, 9-year-old Chargebee offers these companies a way to manage their subscriptions more efficiently.

Chargebee & Pipe – ‘natural’ partners

While the two startups have informally been working together since earlier this year when Pipe first launched in beta (which I covered at the time here), they are now formalizing their partnership, according to Hurst.

The partnership was a “natural” and logical one, he said. Both startups are fast-growing and both serve SaaS companies. Where Chargebee provides the tools for SaaS companies to manage their revenue, Pipe’s goal is to give them a way to monetize those revenues.

Both companies have also raised significant funding rounds this year. Just last month, Chargebee raised $55 million in Series F funding to bring its total venture capital funding to $105 million. The San Francisco-based company has realized “consistent 100% YoY growth,” according to Krish Subramanian, the company’s co-founder and CEO.

“With customers such as FreshWorks, the Superfoods Company, MakeSpace, and many others, we power companies to adapt, experiment, and scale their subscription revenue operations,” he told FinLedger via email.

Meanwhile, Pipe in late June added $60 million in equity and asset financing to its seed round that was announced in February. Since its launch to the public in June, Pipe has seen its revenue grow 84 percent month-over-month, Hurst told FinLedger.

“We’d been unofficially partnered since our launch and have had a live integration between our two companies. Considering there’s so much crossover and overlap between our clients, creating a combined product offering was the obvious nexus,” Hurst told FinLedger. “It’s a cross pollination of our mutual customer base.”

The nitty gritty

So what does the strategic partnership mean exactly?

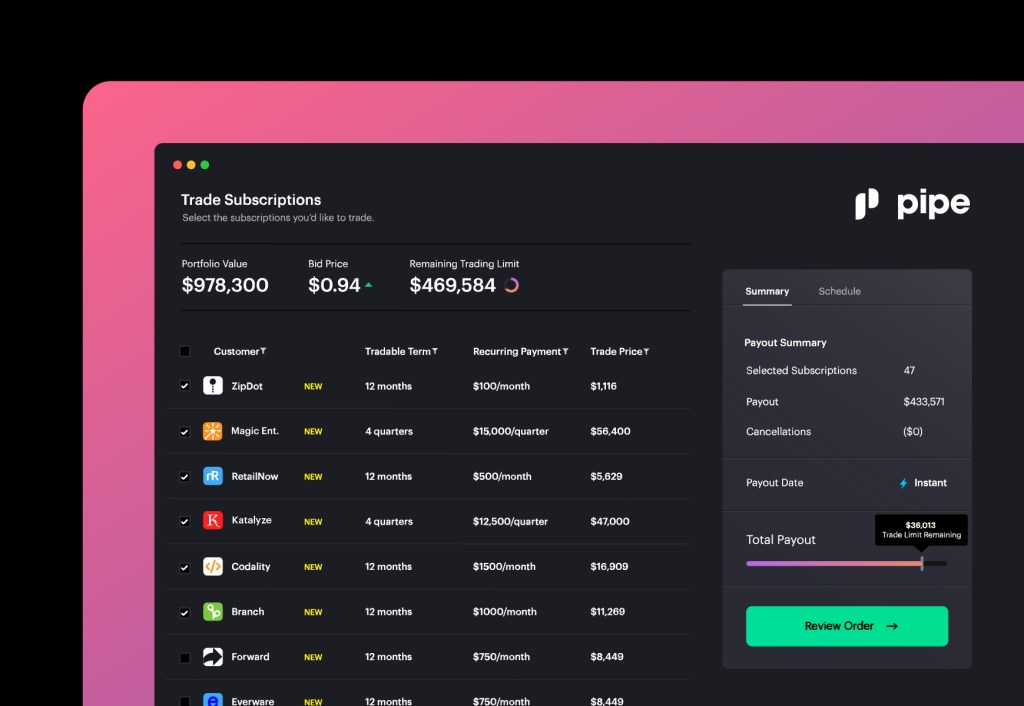

It gives Chargebee’s customers preferred access to Pipe’s exchange and “guarantees the best rates available” as they trade their subscriptions for upfront capital. During onboarding, Pipe customers sync their Chargebee accounts in order to access real-time intel about which subscriptions, or contracts, are available to trade for instant capital on Pipe’s exchange.

Subramanian said the two companies “share a common goal to attract companies, help them grow rapidly and predictably by leveraging our connected platforms.”

“This allows a merchant to scale while reducing the friction in the fuel that funds their growth,” he wrote via email.

Also, Subramanian said the fact that they understand what it is like to be a founder trying to scale and grow.

“We were founders, once before, and believe in supporting the broader entrepreneurial ecosystem,” he added. “In addition to Pipe, we have a Growth Team that engages hundreds of founders through dozens of tech accelerators such as Techstars, 500 Startups, and Y Combinator. This combination of financial and education support along with our respective products, allows us to be part of the success of many early-stage companies and beyond.”

Customer perspective

Chris Lesperance, COO of Sapling, said the process to connect to the Pipe and Chargebee products was more simple than he expected.

“We connected Chargebee and then deals were showing up in Pipe in the next day or two,” he said, noting that his favorite thing about the partnership is that provides “seamless visibility across all of our customer contracts and what we can Pipe and what we have Piped.”

Using what Chargebee and Pipe have to offer has allowed his company to not only streamline cash inflow, but also to “bridge the unpredictability of cashflow timing, particularly during Covid.”